May 12, 2023 | Community Manager |

Financial wellness is a crucial aspect of overall wellbeing. It refers to the ability of an individual to meet their financial obligations and goals. In today’s fast-paced world, financial fitness is increasingly becoming a concern for everyone, regardless of income or social status.

Payroll professionals and accountants have a unique opportunity to help clients or employees achieve financial wellness by identifying the root causes of financial strain and providing strategies to overcome it.

What Causes Financial Stress?

Financial stress is a common experience for many Canadians. It can be triggered by various factors such as unexpected expenses, job loss, or poor financial planning. The worry and anxiety this causes can significantly impact an individual’s well-being, affecting their mental health, physical health, and productivity at work. This is why it is important to monitor what might cause financial stress.

The most common reasons for financial stress are:

- Debt

- Job loss or income reduction

- Unexpected expenses (medical, house/car repairs, etc.)

- Poor financial planning or overspending

- Lack of savings

- Economic downturns (recession, inflation, etc.)

” 38% of Canadians say money is their biggest concern. ”

How Much Financial Stress Is Affecting Canadians?

The 2022 Financial Stress Index reveals that 38% of Canadians say money is their biggest concern, outranking personal health (21%), work (19%) and relationships (18%). Moreover, 39% of Canadians report feeling less hopeful about their financial futures than a year ago, and 35% say financial stress leads to anxiety, depression, or mental health issues.

2022 Financial Stress Index

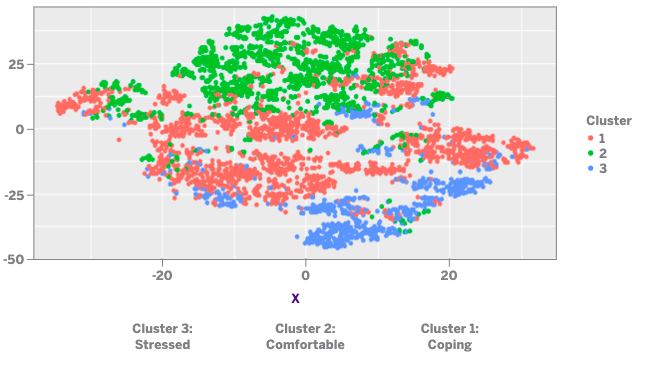

According to the National Payroll Institute’s State of the Nation Report on Financial Wellness, there are three groups of households within the financial wellness spectrum. They can broadly be described as financially “comfortable,” financially “coping,” and financially “stressed.”

“Of particular note is the prevalence of financial fragility. The financially comfortable group is a minority – roughly one-quarter to one-third of the total households. Financial stress is tightly entwined with physical and mental health and flows downstream to productivity, absenteeism and presenteeism issues. If two-thirds of the working population are ‘struggling,’ it doesn’t appear to set the stage for a financially resilient society or economy,” reads the report.

How Can Canadians Assess Their Financial Fitness?

The National Payroll Institute designed a Financial Fitness Evaluator tool based on authoritative research completed by the Western-Laurier Financial Data Analytics Lab.

By answering just a few questions, this evaluation tool can help Canadians better understand the state of their financial fitness and (more importantly) what they can do to move from feeling financially stressed to financially comfortable.

Financial stress affects not only people’s lives but also business productivity. New research from the National Payroll Institute reveals that workers worrying about their financial situation on the job will cost employers more than $40 billion in lost productivity this year. For this reason, companies that need to understand and assess the impact of financial stress on their productivity can use the Financial Fitness Evaluator for Businesses.

What are your main practices to ensure your financial wellbeing? Share your best tips to avoid financial stress in the comments below.

“Financial Wellness: What Causes Financial Stress and How We Can Overturn It?” ?

Sign Up Today! HCM DIALOGUE is more than just a news source – it’s a place for Finance, HR and Payroll professionals to come together and share their expertise.

Comments (3)

Leave a Reply Cancel reply

You must be logged in to post a comment.

In our household, our philosophy is to keep our outgoing less than our incoming, and not keeping a balance on credit (pay it off each pay). We budget for our regular bills and expenses and make an effort to minimize miscellaneous spending, like going out to eat. With increasing costs, it gets much harder to maintain that balance.

Don’t overspend and budget sensibly. It seems challenging but workable.

In my household, I do month-end and look at the expenses. Then we figure out how we can reduce the expenditure.