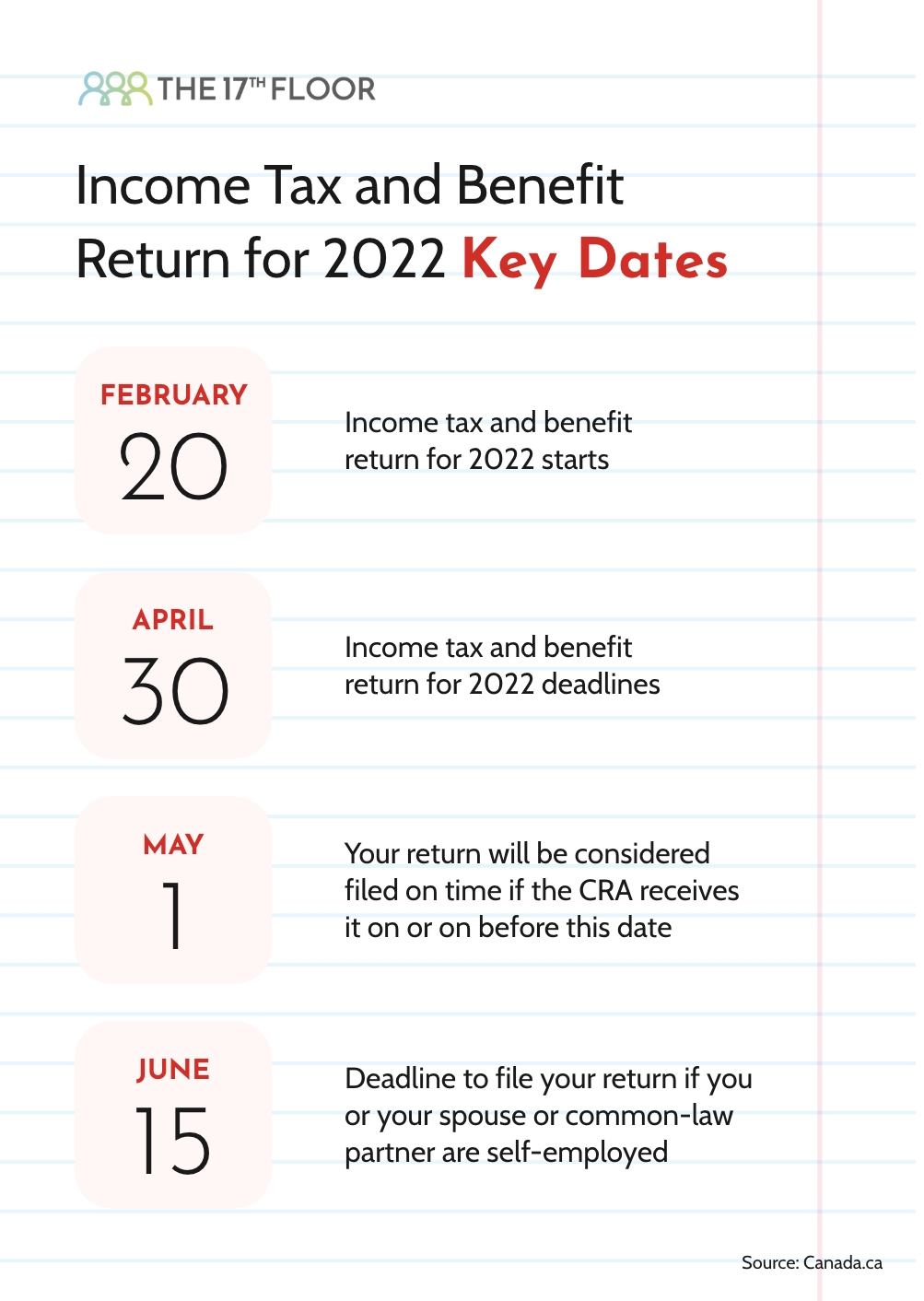

Canada’s Income Tax and Benefit Return for 2022: Key Dates & Deadlines

Extract from a publication by the

Canada Revenue Agency.

No one likes last-minute delays or waiting on the phone at tax time. You can avoid this by preparing early and using Canada Revenue Agency’s (CRA) digital services. You will be able to update your personal information and view your tax and benefit information ahead of time.

Things to keep in mind:

-

Filing your return before the deadline will allow you to avoid interruptions to any refund, benefit or credit payments you may be eligible for.

-

If you owe money to the CRA, your payment will be considered on time if the CRA receives it, or a Canadian financial institution processes it, on or before May 1, 2023.

-

CRA encourages registration for My Account at My Account for Individuals before the rush of tax season.

-

You should also register for direct deposit and make sure that your information is up-to-date before you file your return.

For more information you can download The 17th Floor’s Personal Taxes Kit, or reach out for help using our forum.

Do you usually file your income tax and benefit return on time or wait until the last minute? Let us know in the comments section below.

Sources: