October 13, 2023 | Community Manager |

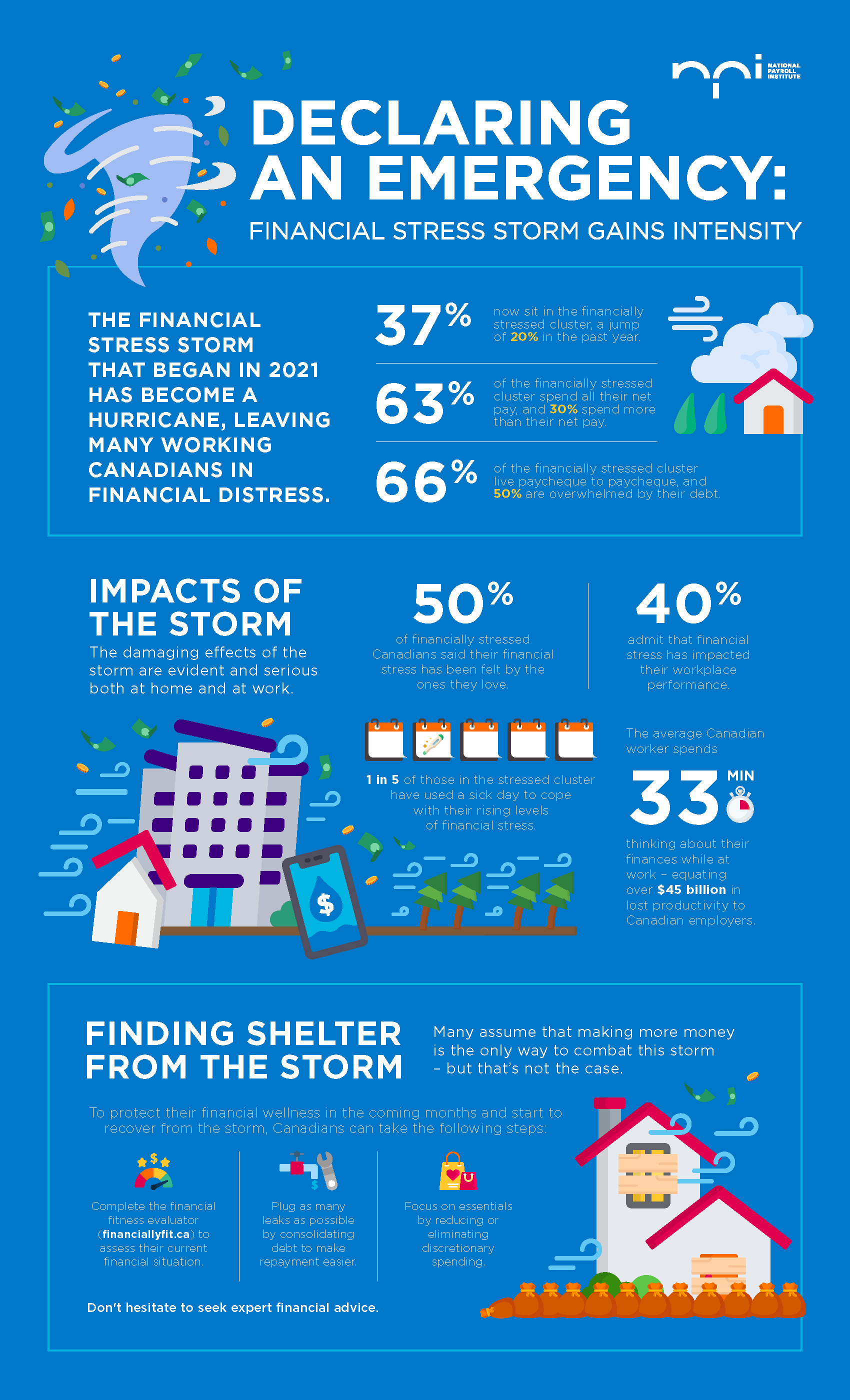

According to an analysis of the National Payroll Institute’s Annual Survey of Working Canadians conducted by Canada’s Financial Wellness Lab, the number of working Canadians facing financial stress has surged by 20% in the past year alone, reaching an alarming 37% overall. This trend began in 2021, following a brief respite during the pandemic-induced lockdowns in 2020.

The primary factors contributing to financial stress include increasing debt, inadequate savings, and excessive spending. With rising interest rates, inflation, and the cost of living, these challenges have negatively impacted the financial wellness of many working Canadians, making it crucial for them to take immediate action.

” 40% of stressed individuals report a negative impact on their job performance, and 20% had to take sick days to cope with the increasing financial stress. ”

The ramifications of this financial storm are not limited to individuals; they extend to workplaces as well. Financial worries are eroding productivity and employee engagement, with 40% of stressed individuals reporting a negative impact on their job performance.

On average, Canadian workers spend 33 minutes daily thinking about their finances at work, resulting in an estimated $45 billion in lost productivity for Canadian employers.

Moreover, one in five survey respondents had to take sick days to cope with the increasing financial stress, and one in ten considered leaving their jobs altogether.

Earning more money, while a common solution, is not the sole key to improving financial wellness. The research reveals that 35% of those in the growing stressed cluster earn over $100,000 annually. Instead, reducing reliance on debt and consolidating existing debts can significantly alleviate financial stress, given the high interest rates in the current economic climate.

To address these challenges, working Canadians need to make difficult choices regarding spending and prioritize essential expenses. Seeking professional financial advice can also be a valuable step toward achieving financial stability.

Canadian employers have a role to play in mitigating the financial storm’s impact. Tools such as the National Payroll Institute’s Financial Fitness Evaluator for Business can help gauge financial stress among employees and implement appropriate solutions. Encouraging automatic savings and investing in payroll professionalism to prevent delays can also be effective measures.

The current financial crisis in Canada is a severe emergency, and immediate action is required at both the individual and employer levels to weather the storm and secure a more financially stable future.

Sources:

“Financial Stress at Its Peak: Canadians Facing a Deepening Financial Crisis” ?

Sign Up Today! HCM DIALOGUE is more than just a news source – it’s a place for Finance, HR and Payroll professionals to come together and share their expertise.

Comments (7)

Leave a Reply Cancel reply

You must be logged in to post a comment.

The Financial Fitness Evaluator is a great way to understand your personal financial situation. Thanks for sharing this resource.

Glad it helps 🤩

Adding Financial Wellness initiatives to your organization’s Employee Wellness Program is more important than ever. There are so many free resources that you can add to your program, in addition to leaning on your benefits and retirement plan providers. One resource that is worth checking out is CPA Canada. They have a Financial Literacy Program that includes the offer of free seminars for certain groups. Check it out here: https://www.cpacanada.ca/en/public-interest/financial-literacy

Thank you for sharing this tool, Lisa 🙌

I think it’s important to offer “pay yourself first” options for employees such as allowing pay to be deposited into multiple bank accounts to encourage saving or an employer-matching pension plan that encourages employees to contribute. Posters and information about why paying yourself first is important and how to do it, on the bulletin boards.

I agree, offering “pay yourself first” options is a great idea. It encourages financial wellness among employees. Additionally, providing educational materials through internal communications is an excellent way to raise awareness and guide employees on managing their finances effectively. Thanks for your comment, Kelly!

I agree with this very much. We offer our employees the option of directing a portion of their pay to a separate bank account as well as RRSP deductions.